Introduction

A recent research suggested that almost all stakeholders in the real estate sector believe that the industry can be a game changer in attaining net zero carbon goals. The study further states that if some way could be found to reduce commercial real estate’s GHG to less than 20% (currently 40%), India would rank in the top three most sustainable firms.

With sustainability entering the boardroom talks quite frequently, India is already thinking green. This piece will explain the various aspects surrounding the net zero carbon goals.

The Indian CRE Background

It is interesting to know that according to a pan-India poll, almost 87% of occupiers and 78% of investors believe climate risk poses a financial risk. In India, occupiers are increasingly concerned with sustainability, and real estate is central to this. Almost 87% of those,, in their opinion, believe the relationship between Corporate Real Estate (CRE) and sustainability is a board-level priority. In India, occupiers are ahead of investors regarding sustainability objectives, with 82% of occupants either leading or on the way, compared to 66% of investors.

On-Ground Scenario

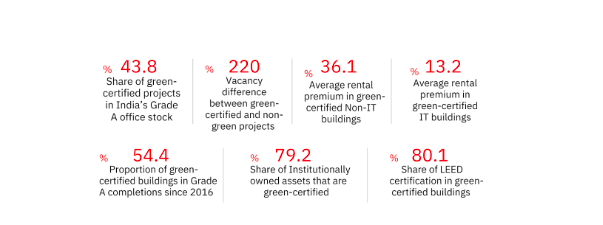

Indian real estate is well on its way to becoming more sustainable, and green certifications indicate this change. There are tangible benefits of being a green-certified building. These are not limited to lower operational costs and efficiencies in running the building but also adding a premium to the asset value. Making a building more sustainable through various interventions also increases the life span of a building and is a key part of futureproofing the asset. This supports and ensures longer tenant occupancies and, keeps an asset relevant.

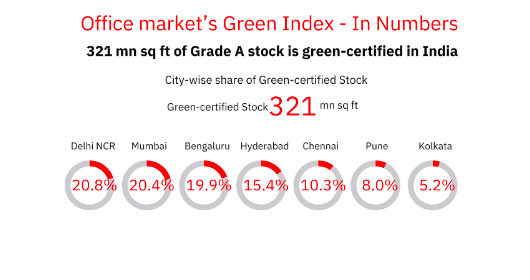

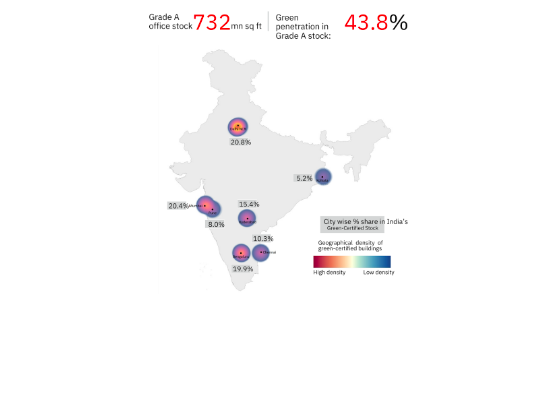

A bird’s eye view of India’s green footprint

Amongst the top 3 locations, Delhi NCR, Mumbai, and Bengaluru account for 61% of the green-certified stock across the country. India’s Grade A office stock of 732 mn sq ft has a 43.8% green certification coverage, which translates to 321 mn sq ft. Delhi NCR leads in terms of the overall share of green-certified stock with 20.8%, with Mumbai and Bengaluru following close with 20.4% and 19.9%, respectively. The top four cities in terms of overall Grade A office stock – Bengaluru, Mumbai, Delhi NCR, and Hyderabad account for over 3/4ths of the existing green footprint.

The Mission

India must will need to take modest initiatives to achieve net-zero carbon emissions by 2070. With firms now pledging strong zero-emission objectives for the next decade, the built environment must follow up. Investing in technology to monitor and adequately report emissions will be just as crucial as creating clear, realistic targets within specific time frames.

Changing Reality

Sustainability is driven by many factors, both macro and micro. Since we have discussed the macro level upfront, let’s get into the in-depth analysis of micro-level activities, which Omni-stakeholders could take up and considerably add to the cause. Green buildings are the core driving factor at both levels, as 57% of occupiers have already achieved green building certification, and 40% aspire to have market-recognized sustainability certification for their portfolio by 2025. Two-thirds of all occupier respondents say they already pay a 4-10% premium on rents for sustainability certifications. This trend continues as 92% of respondents are willing to pay a rental premium to take up certified office buildings.

Ambitious decarbonization goals need a multipronged, actionable strategy at a firm level. A significant opportunity lies in tackling the carbon emissions from real estate, whether owned or leased. Recognition of this fact is evident given that 96% of occupiers agree that real estate is a game-changer in achieving the net-zero carbon agenda.

Furthermore, for 77% of occupiers, carbon emissions reduction is part of their real estate strategy. A majority of occupiers (93%) agree that they will proactively prioritize locations that help them reduce carbon emissions in the future, and investors (65%) agree that they would prioritize investing in climate change-progressive cities.

Starting of Chain Reaction

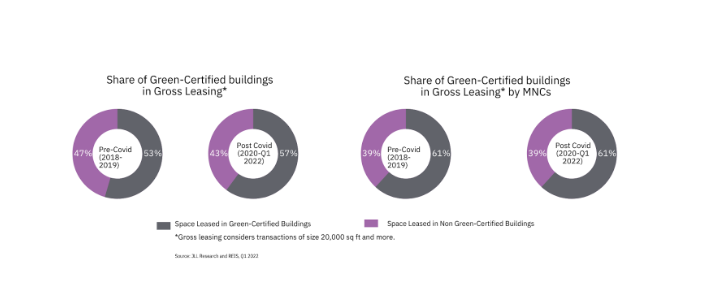

In India, we witness a top-down approach, as occupiers had been the leading stakeholders in the real property universe, driving the shift in the direction of weather-aware and inexperienced homes. Even within the two-year duration right now, previous to the pandemic, the share of gross leasing in green-certified buildings became better at 53%. It rose similarly to 57% for the time of the COVID period, genuinely outlining the more significant, more remarkable shift underway in occupier possibilities for sustainable, green-certified homes. Worldwideworldwide companies have shown extra sustainability attention in their real property selection-making and accordingly had been skewed in their leasing interest, with 61% of the distance leased by way of them during the last four4 years being in green-certified buildings. That is additionally indicative of the truth that the maximum quality supply being delivered across the towns through institutional and large landlords have already got green certification and necessarily such buildings garner a bigger hobby among worldwide occupiers, resulting in higher leasing traction for such initiatives.

Measurable Steps

To attain this, micro measures like using eco-friendly building materials, from paints to exterior and interior fit-outs. The scope is limitless as there is an eco-friendly alternative to everything that commercial real estate would require. Major thrust factors would include solar, since this has long-term positive effects and the results are lucrative, in terms of cost-benefit analysis. Effective alternative power resource could take off about 30-40% of power consumption costs and has an ROI in a quick 5-year turnaround time. With innovation and advanced technology available at our fingertips, we have super-efficient electrical fitments which could reduce overall energy consumption by 40%, adding to the value chain.

The other major factor would include rainwater harvesting and using of STPs, to their maximum benefit. Rainwater harvesting is also a mandate by Indian Law for the majority of Indian Commercial Real estate to abide by. It is a pretty easy method, as one needs to allocate a special zone and design the area in such a way that the rainwater is collected without much loss. A proper filtration system helps to segregate the dirt and the freshwater is stored for treatment which can be widely used later on. Rainwater harvesting if done properly, has the ability to reduce freshwater fresh water consumption by 40-50%

Summary

To summarise, sustainability as an economic risk has become the primary topic of discussion in boardrooms. It has the potential to change business, industry, and society. Because of its inherent existence across all sustainability-driven challenges, real estate may be a vehicle of significant change and offer actual answers. It is a high-impact sector in terms of lowering global greenhouse gas emissions. The industry can not otcanNot only can the sector affect change by reinventing the physical environment. Still, it can also improve the health and well-being of employees, consumers, and residents by fostering social sustainability, accessibility, inclusion, and diversity.